Amazon Stock Undervalued Outlook With Strategic Growth Potential

Amazon Stock Undervalued: Examining the Potential Behind the Market Price

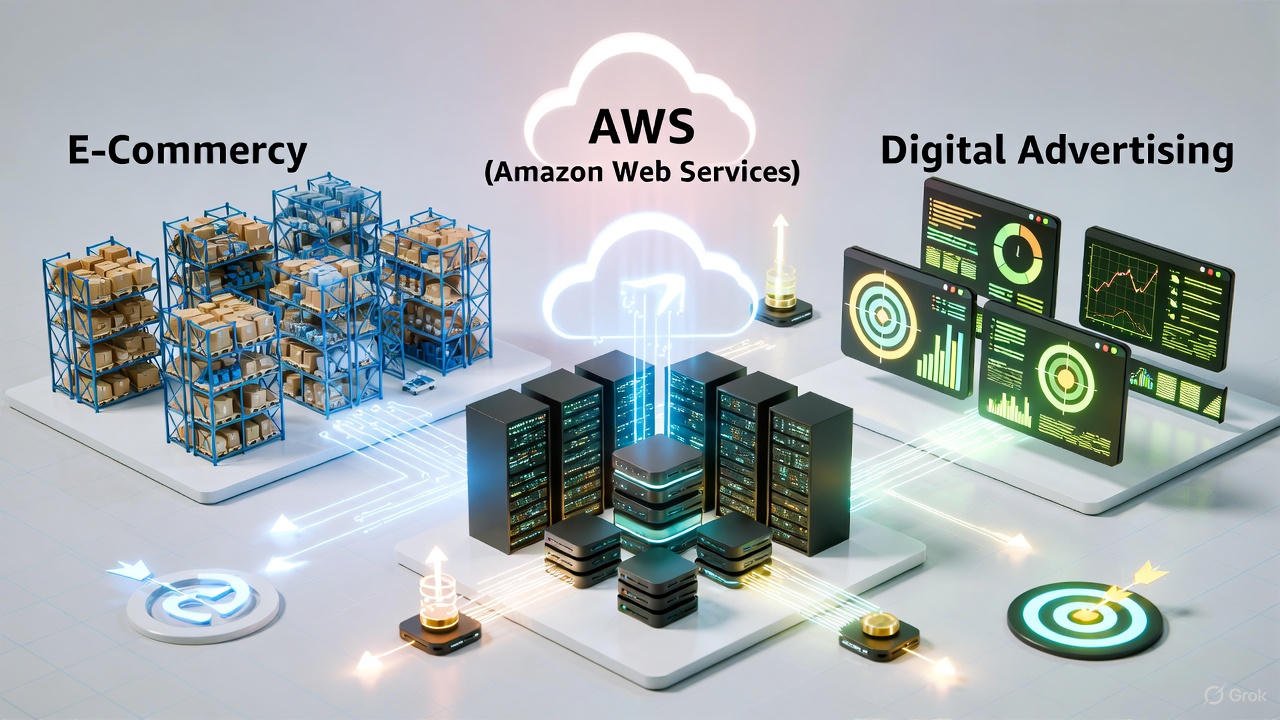

The Amazon stock undervalued narrative is gaining attention as shares trade below certain fundamental benchmarks. Despite fluctuations in near-term earnings, Amazon’s diversified business spanning e-commerce, cloud computing, and digital advertising provides multiple long-term growth drivers that may not be fully reflected in the current market price.

This article explores why Amazon might be undervalued, key segments driving future performance, and what investors should consider in their long-term strategy.

Why Amazon Stock Is Viewed as Undervalued

Some investors suggest that Amazon shares trade below levels justified by its long-term growth potential. Valuation metrics such as price-to-earnings ratios and discounted cash-flow models indicate that the stock may be trading at a discount relative to expected future earnings.

Segments like AWS and digital advertising generate significant profits, yet current prices may not fully capture their long-term potential, creating a debate around the stock’s true value.

Key Drivers Behind the Undervalued Narrative

1. Amazon Web Services (AWS)

AWS remains a central engine of profitability for Amazon. Leading the cloud infrastructure market, it powers enterprise AI workloads and scalable computing services. AWS continues to expand rapidly, contributing high-margin profits that support the case for Amazon stock being undervalued.

2. Digital Advertising

Amazon’s advertising business has grown into a high-margin revenue stream outside of its core e-commerce and cloud operations. As more brands invest in digital shopping ads, this segment provides additional revenue and strengthens long-term profitability, supporting the notion that the stock may be undervalued.

3. AI and Long-Term Investments

Amazon invests heavily in AI across AWS and e-commerce operations. While these investments can impact near-term cash flow, they enhance long-term growth potential, positioning Amazon to capitalize on increasing AI adoption in enterprise and consumer applications.

Valuation Signals and Market Considerations

Valuation methods such as discounted cash-flow analysis suggest that Amazon’s intrinsic value may exceed current market prices. While some metrics indicate the stock is expensive compared to traditional retail peers, high-growth segments like AWS and digital ads justify higher multiples, contributing to debate over whether Amazon is undervalued.

Growth Opportunities Supporting the Investment Case

E-commerce and Logistics Expansion

Amazon’s logistics and fulfillment network supports continued e-commerce growth. Efficiency gains and third-party seller expansion help improve margins and drive revenue over time.

Prime Ecosystem

Amazon Prime membership boosts customer retention and spending, with subscriptions spanning video, music, and exclusive delivery benefits. This ecosystem strengthens long-term revenue stability.

Risks and Considerations

Capital Expenditures

Heavy investments in cloud infrastructure and AI capabilities can suppress free cash flow in the short term. Investors need to weigh these costs against long-term growth potential.

Competition

Intense competition in both cloud computing and e-commerce requires Amazon to innovate continuously to maintain market leadership, introducing potential risks to growth.

Helpful Resources

- Amazon investor relations and financials: https://ir.aboutamazon.com/

- Overview of AWS cloud growth: https://aws.amazon.com/what-is-aws/

Conclusion

While debate continues, the Amazon stock undervalued thesis has merit based on AWS growth, digital advertising expansion, and AI initiatives. For long-term investors, Amazon’s diversified business model, technological edge, and strong customer ecosystem suggest the stock may present a strategic opportunity that is not fully reflected in its current price.

One Comment