Nvidia AI Chip Strategy Reveals How Cash Reserves Drive Competitive Advantage

Nvidia AI Chip Strategy: How Massive Resources Fuel Industry Leadership

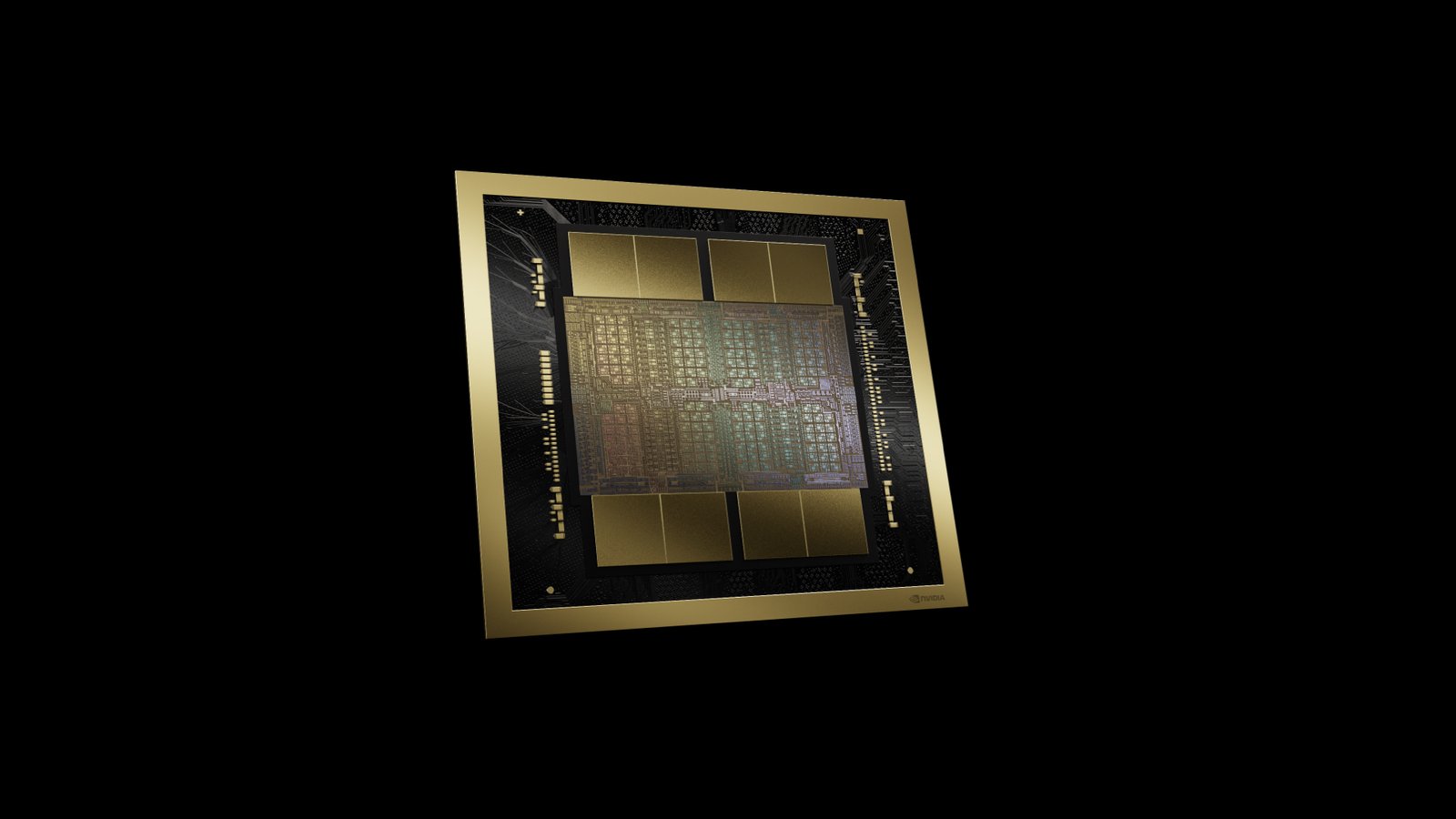

The Nvidia AI chip strategy is drawing intense attention as the company makes one of its largest strategic technology moves yet. By leveraging its substantial financial strength, Nvidia has secured advanced chip technology and top engineering talent to strengthen its ecosystem. This move underscores how a dominant balance sheet can accelerate innovation and maintain competitive advantage in the rapidly evolving AI landscape.

From commanding market share in AI training hardware to expanding into inference and specialized processors, Nvidia’s approach demonstrates how financial resources and strategic positioning can influence the future of computing.

How Nvidia’s AI Chip Strategy Is Shaping the Market

Artificial intelligence workloads are expanding beyond traditional graphics processing units (GPUs). While Nvidia’s GPUs have powered the bulk of AI model training, emerging technologies are challenging the company to extend its hardware portfolio.

Recently, Nvidia struck a strategic deal to license advanced chip designs and integrate key engineering talent. This transaction allows Nvidia to accelerate AI innovation without relying solely on internal R&D and demonstrates how financial resources enable strategic flexibility in a competitive industry.

The Role of Financial Strength in Nvidia’s Strategy

A defining feature of the Nvidia AI chip strategy is the company’s ability to leverage its massive cash reserves. This financial strength allows Nvidia to pursue strategic technology licensing and talent acquisition without short-term profit pressures.

By integrating new capabilities and refining its hardware ecosystem, Nvidia can innovate faster and respond more effectively to AI market demand. This approach also provides flexibility in regulatory environments, as licensing technology and hiring personnel can achieve similar outcomes to acquisitions without triggering compliance concerns.

Why This Technology Licensing Deal Matters

The deal focuses on securing specialized chips optimized for AI inference the stage where trained AI models generate outputs in real time. While Nvidia’s GPUs excel at training large AI models, these inference-focused processors improve efficiency, reduce energy consumption, and accelerate real-time AI applications.

This strategic integration ensures Nvidia’s ecosystem remains competitive, strengthens its market position, and consolidates engineering expertise that will help drive innovation across AI hardware and systems.

Expanding Presence in AI Infrastructure

Nvidia’s strategy extends beyond individual hardware products. The company supports a wide range of AI initiatives through partnerships, investments, and licensing arrangements across the technology sector.

This multi-layered strategy ensures Nvidia remains central in AI infrastructure from enterprise data centers to cloud services creating a robust ecosystem that spans both AI training and inference workloads.

Market and Competitive Implications

Positioning Against Competitors

Nvidia’s strategy comes as competitors, including tech giants and specialized chip firms, expand their AI hardware offerings. By integrating cutting-edge inference technology and acquiring talent, Nvidia aims to neutralize potential threats and maintain leadership in AI computing.

Regulatory Considerations

While strategic, Nvidia’s approach also considers regulatory scrutiny. Structuring technology agreements and talent integrations carefully helps Nvidia innovate without encountering acquisition-related regulatory hurdles, allowing the company to scale its AI influence responsibly.

Helpful Resources

- Overview of AI hardware and GPUs: https://www.nvidia.com/en-us/data-center/

- Understanding AI inference vs. training: https://www.ibm.com/cloud/learn/ai-inference-vs-training

- Tech financial insights: https://www.investopedia.com/terms/b/balance-sheet.asp

The Future Outlook for Nvidia’s AI Hardware Strategy

The outlook for Nvidia’s AI dominance depends on several key trends:

- Expansion of AI Workloads: Growing adoption of AI across industries increases demand for both training and inference hardware.

- Efficiency and Performance: Specialized AI chips will become critical for energy-efficient, high-performance computing.

- Integrated AI Platforms: Successful integration of diverse hardware technologies into unified systems will differentiate market leaders.

Nvidia’s combination of financial resources and strategic vision positions it as a central player in the next phase of AI hardware evolution.

One Comment