DAX Reaches New Milestone with a Strategic Market Perspective

DAX Reaches New Milestone with a Defining Market Shift

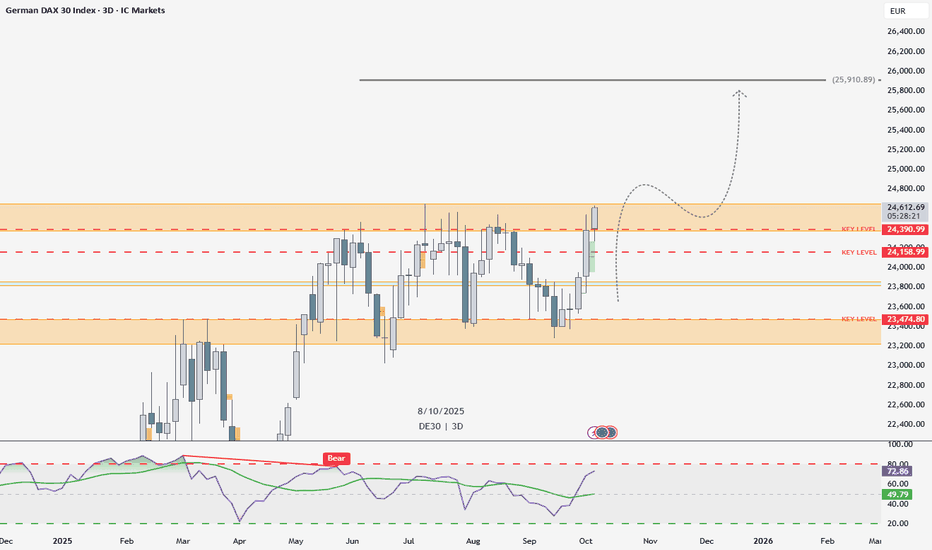

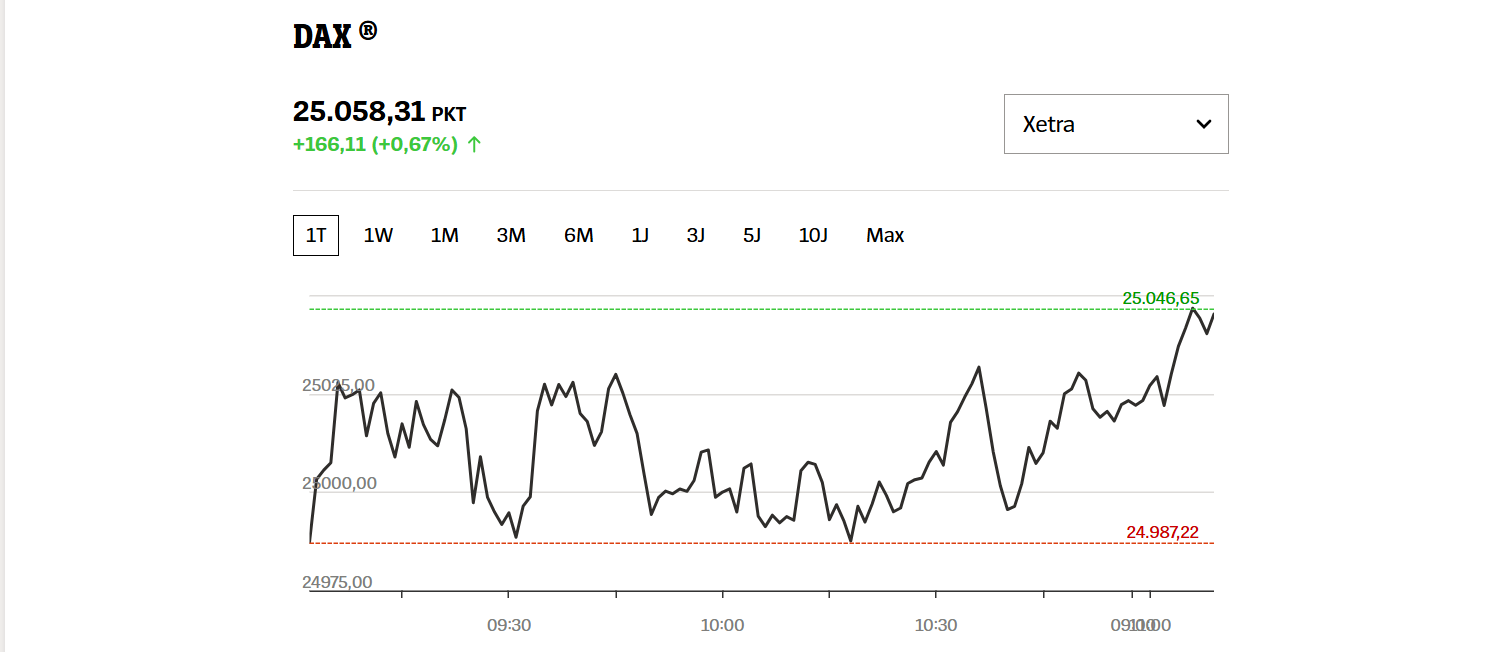

DAX reaches new milestone as Germany’s leading stock index moves into previously uncharted territory, drawing attention from investors, analysts, and policymakers alike. The crossing of the 25,000-point threshold is more than a symbolic headline it reflects deeper trends in global markets, corporate performance, and investor expectations.

This article breaks down what this development means, why it happened now, and how it fits into the broader economic picture. Whether you follow European markets closely or are simply tracking global financial signals, understanding this moment offers valuable insight.

Understanding What It Means When the DAX Reaches New Milestone Levels

The DAX is Germany’s primary equity index, representing 40 of the country’s largest publicly listed companies. These firms span industries such as manufacturing, finance, technology, healthcare, and energy, making the index a useful snapshot of corporate Germany.

When the DAX reaches new milestone territory, it signals that investor confidence in these companies is strong enough to push valuations higher. However, this does not always translate directly into economic conditions on the ground. Stock markets often move ahead of broader economic indicators.

Why the DAX Reaches New Milestone Territory Now

Several overlapping factors have contributed to this move.

Global Market Momentum and the DAX Reaches New Milestone Status

International markets have shown resilience, particularly in the United States, where major indices have continued to perform steadily. European markets often follow this direction, especially when global investors seek exposure beyond U.S. equities.

As global capital flows into developed markets, Germany’s export-oriented corporations benefit, helping explain why the DAX reaches new milestone levels alongside broader international trends.

Corporate Earnings Support as the DAX Reaches New Milestone Levels

Many DAX-listed companies generate a significant portion of their revenue outside Germany. Strong performance in international markets, combined with cost controls and pricing strategies, has supported earnings.

This corporate strength plays a central role whenever the DAX reaches new milestone territory, as investors tend to reward predictable revenue and global diversification.

Policy Expectations and Market Confidence

Investor sentiment has also been influenced by expectations around fiscal policy, infrastructure spending, and long-term industrial investment in Germany and the wider European Union. These expectations can lift markets even before policies are fully implemented.

In this context, it becomes easier to see why the DAX reaches new milestone points even while some economic indicators remain mixed.

DAX Reaches New Milestone but the Economy Tells a Broader Story

While stock indices attract attention, they do not always reflect everyday economic reality.

The Difference Between Stock Performance and Economic Output

The DAX measures share prices, not employment levels, wage growth, or small business activity. A rising index can coexist with slow economic growth or sector-specific challenges.

This distinction is essential when interpreting headlines announcing that the DAX reaches new milestone levels. Financial markets price in expectations, while economic data often looks backward.

Export Strength and Global Exposure

Germany’s largest companies benefit from global demand, particularly in industrial goods, automobiles, and advanced manufacturing. Even if domestic consumption slows, international exposure can sustain profits.

That global reach helps explain why the DAX reaches new milestone territory despite ongoing discussions about economic restructuring at home.

How Investors Interpret It When the DAX Reaches New Milestone Levels

From an investor perspective, milestone levels often carry psychological weight.

Psychological Thresholds and Market Behavior

Round numbers tend to attract attention, influencing short-term trading behavior. Some investors see them as confirmation of momentum, while others view them as potential pause points.

When the DAX reaches new milestone marks, trading volumes often increase as market participants reassess positions.

Long-Term Investors and Structural Trends

For long-term investors, the focus is less on the number itself and more on what drives sustainable growth. Structural factors such as digital transformation, energy transition, and industrial innovation remain central.

Milestones matter, but fundamentals determine whether gains hold over time.

Sector Performance as the DAX Reaches New Milestone Territory

Not all sectors contribute equally to index movements.

Industrial and Manufacturing Influence

Industrials carry significant weight within the DAX. Order backlogs, international contracts, and infrastructure demand have supported these stocks.

Their performance is a key reason the DAX reaches new milestone levels during periods of global investment expansion.

Financial and Technology Contributions

Banks and financial services firms benefit from stable interest rate environments and capital market activity. Meanwhile, technology-focused companies gain from automation and digitalization trends.

Together, these sectors add balance to the index, supporting its upward movement.

Risks to Consider Even as the DAX Reaches New Milestone Levels

Market milestones do not eliminate risk.

Geopolitical and Trade Factors

Global trade relations, geopolitical tensions, and regulatory changes can quickly affect export-driven companies. Any shift in these areas may influence future index performance.

Monetary Policy and Market Sensitivity

Interest rate decisions by central banks remain a critical factor. Changes in borrowing costs can influence valuations, particularly in capital-intensive industries.

These risks remain relevant even as the DAX reaches new milestone territory.

What This Means for Individual Investors

For retail investors, headlines about market milestones can be both exciting and confusing.

Helpful Resources

- https://www.deutsche-boerse.com

- https://www.reuters.com/markets/europe

- https://www.bloomberg.com/markets

Maintaining Perspective

Rather than reacting to short-term movements, investors often benefit from focusing on diversification and long-term goals. A single index level should not dictate investment strategy.

Using Milestones as Context, Not Signals

When the DAX reaches new milestone points, it provides context about market sentiment not necessarily a clear buy or sell signal. Understanding the reasons behind the move is more valuable than the number itself.

Key Takeaways

When the DAX reaches new milestone levels, it captures attention far beyond Germany’s borders. This movement reflects a mix of global market momentum, corporate strength, and investor expectations rather than a single economic factor.

Understanding the forces behind the headline helps put the milestone into perspective. For investors and observers alike, the real value lies not in the number itself, but in what it reveals about market dynamics and future possibilities.

One Comment